Expanding the Scope of Emissions

September 17, 2022

Expanding the Scope of Emissions

Investors gain a new ETF vehicle for the global carbon market, and companies begin to grapple with measuring the positive side of emissions.

And in the meantime, a climate tech company gains a $55 million fund to expand its operations.

In the midst of a week of dramatic turnarounds and headlines, the VCM keeps marching on.

Here we go.

The NKOTB - Plastic Credits

As the carbon credit market matures and gains more acceptance, there is a new kid on the block - Plastic Credits.

The Plastic Waste Reduction Program framework is based on a Verra methodology and companies are already working on projects to tackle this climate problem, while reaping the rewards of the credits produced.

This week, ClimeCo announced a partnership with Enaleia to reduce plastic pollution in Kenya via a plastic collection project.

Scope 1, 2, 3 . . . . and 4?

Companies group emissions types by scope, allowing them to distinguish emissions caused directly by the company from emissions resulting indirectly from the company’s products and processes.

But as advances are made in CCS tech and companies get more efficient, there’s a growing push to factor in any emissions prevented.

That could include direct avoidance or even emissions avoided by a company’s products. These proposed Scope 4 emissions would go into the positive side of the ledger.

There are still some problems with measuring Scope 4 emissions as methodologies vary, and in even determining what exactly qualifies as scope 4 (there’s no settled definition).

Nevertheless, the idea is potentially vitally important in a more holistic approach to emissions.

Eat Your KARBs

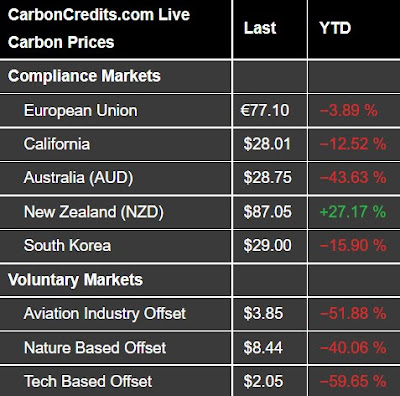

From Carbon Fund Advisors comes the newest carbon ETF on the NYSE, the appropriately-named KARB. The ETF features futures contracts from the big players in the regulatory carbon markets, including:

• European Union Allowances

• California Carbon Allowances

• US Regional Greenhouse Gas Initiative Allowances

• UK Emissions Trading Scheme

You could also call it the cap-and-trade ETF. Regardless, the KARB ETF provides solid exposure to the leading names in the global carbon market.

Patch Me Through

Call it democratizing carbon offsets, or at least, call it an attempt to integrate carbon offsets with digital products. The Patch platform features an API that lets companies build in offsets for their purchasers.

Customers see a running tally of their carbon emissions as they shop, and then purchase offsets to reset their balance.

It’s one more way that VCM is attempting to bridge the gap between theory and practice and make carbon offsetting a normal part of life for more individuals.

Carbon Fact of the Week

Investing in carbon removal tech is often seen as a subset of Environmental, Social, and Governance (ESG) investing.

New investment into ESG doubled from 2019-2020, reaching over $50 billion.

One year later, new money continued to flow in ESG - almost $70 billion.

ESG investments are expected to include nearly half of all managed assets by 2050.

.jpg)

.jpg)

댓글

댓글 쓰기