Carbon Capital is Coming

December 3, 2022

Carbon Capital is Coming

One company is using renewable biowaste called lignin to create wood batteries, while two others work together to make the first net zero milk project in New Zealand.

A Saudi Arabian renewables developer closes a $7 billion deal to build green hydrogen in Thailand. Meanwhile, a carbon credit firm aims to raise $1 billion to fund projects that remove carbon from the air.

Interesting stories worth billions are up this week, so let’s dive in.

Batteries Made of Wood?

Companies have been busy finding ways to provide sustainable power storage solutions using renewables. And one of the largest forest owners in the world, Stora Enso, has started to scale the production of batteries made out of wood.

Their source is a biomaterial called lignin. It’s one of the most common organic polymers found in trees that makes their structure firm and resistant to rotting.

Lignin has a high carbon content of 60% and makes up about 30% of wood’s composition.

The lignin is turned into a fine carbon powder that’s then made into electrode sheets or rolls, replacing mined graphite, which has a larger footprint.

What’s more remarkable is that carbon found in lignin can be enough to end the use of fossil fuels and mined metals in storing power.

The 1st Net Zero Milk Farm

New Zealand has the lowest carbon footprint for milk globally, but dairy still contributes 50% of the country’s livestock emissions.

So, Nestle and NZ’s largest milk processor, Fonterra are working together to develop the first net zero dairy farm in the region.

Their project will assess the farm’s total carbon emissions on a 290-hectare property. The pilot project will run for 5 years and aims to cut emissions by 30% by 2027 and hit net zero in 10 years' time.

If it ends up well, the pilot scheme will help both companies achieve their net zero goals.

$7B Green H2 Deal

Green hydrogen has been touted as the energy of the future.

ACWA Power, a Saudi Arabian firm, signed a $7 billion deal with two Thai state-owned agencies to develop green hydrogen in Thailand.

They aim to produce around 225,000 tons of green H2 yearly or about 1.2 million tons of green ammonia.

The partnership will first focus on doing an investment feasibility study for the proposed green Hydrogen projects in Thailand. ACWA Power had also struck similar deals in Indonesia for the same reason.

A $1 Billion Worth of Access

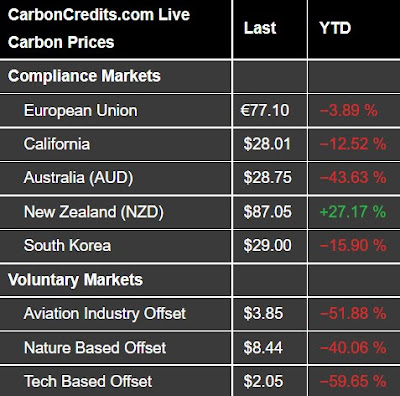

Billions of dollars have already been traded in the carbon credit markets.

Carbon credit firm Rubicon Carbon said it will raise $1 billion to source and fund projects that remove carbon and then sell the credits they create.

Rubicon was founded by TPG Rise Climate following the merger of Bluesource (carbon credits provider) and Element Markets (distributor of environmental commodities).

The new fund aims to fix issues plaguing the market, such as the limited supply, insufficient project financing, and make access to the market easier.

Carbon Fact of the Week

To support the massive demand for electric vehicles (EVs) by 2050, battery production must also scale up.

Global lithium production totaled 100,000 tons (90.7 million kg) in 2021 while worldwide reserves are at about 22 million tons (20 billion kg).

A lithium-ion battery pack for a single EV contains about 8 kilograms (kg) of lithium.

EV sales stood at 6.6 million in 2021 and lithium reserves are only enough to produce up to 14 million EVs in 2023.

According to the IEA, the world needs 2 billion EVs on the road by 2050 to hit net zero.

Source: https://carboncredits.com/

.jpg)

.jpg)

댓글

댓글 쓰기