The Carbon Roller Coaster

December 10, 2022

The Carbon Roller Coaster

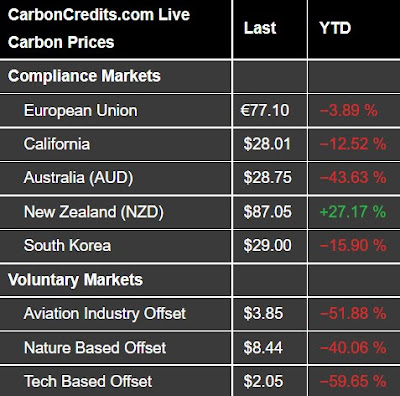

The voluntary carbon prices this week saw a massive one-day drop in and followed up by a partial bounceback.

A global energy firm signs a $750M carbon credits deal with a South American nation and Vanguard walks away from the Net Zero Asset Managers Initiative.

Meanwhile, the London Stock Exchange names the first fund to use its new framework for carbon credits while the World Bank and its partners launch a new carbon credit platform.

So, lets jump in.

The Forest from the Trees

Reducing Emissions from Deforestation and Forest Degradation programs, a.k.a. REDD, are critical to limit the global temperature rise to below 2°C.

Guyana, one of the most heavily forested countries in the world, has ~18 million hectares of forests that can store about 20 billion tonnes of CO2e.

The country signed an agreement with oil giant Hess Corporation, who’ll buy $750 million worth of its REDD+ carbon credits to help protect its Amazonian rainforests.

LSE’s First to Digest

The London Stock Exchange (LSE) finally launched its voluntary carbon market (VCM) framework. Its goal is to create a way for those seeking capital for climate solutions that generate carbon credits.

This week, LSE welcomed the first fund to use its new platform - the Foresight Sustainable Forestry Company.

The London-based investment firm offers direct access to UK forestry projects, with future exposure to the VCM.

While the Exchange’s new platform aims to help fix market transparency issues, it may take some time to raise enough funds. In other words, it’s going to take a little bit of time for the market to digest.

The Trust That VCM Needs

Critics of the VCM continue to shake the market with concerns over poor transparency, limited supply, and project quality. In short, they don’t trust what’s going on in the market.

And so the World Bank, along with the IETA and Singapore, launched another new carbon credit tracking system they call “Climate Action Data or CAD Trust”.

The goal is to bring transparency to the market and help countries raise climate finance faster and more affordable.

The launch of CAD Trust marks a significant step in the evolution of carbon markets by integrating several registries into an openly accessible and secure digital system.

VCM's Volatile Prices

After enjoying record-breaking carbon prices earlier this year, liquidity is drying up in the carbon sector.

Vanguard’s move to quit the Net Zero Asset Managers Initiative (NZAMI), sent shockwaves through the industry. It marks the biggest defection to date, and it will be interesting to see if any other companies follow Vanguard’s exit, or whether they maintain their commitments.

Source: https://carboncredits.com/

.jpg)

댓글

댓글 쓰기