Carbon Falling into the Deep

March 4, 2023

Carbon Falling into the Deep

A climate tech company publishes the world's first ocean-based carbon removal protocol while the largest carbon exchange releases its trading insight for 2022.

Meanwhile, a forest carbon offset fund closes $242 million in funding while the Department of Energy rolls out $2.52 billion to fund two carbon capture initiatives.

Let’s dig in!

Upgrading Carbon’s Biggest Reservoir

MRV - measurement, reporting, and verification - is one key to showing that carbon reduction efforts are paying off and driving more investments into climate actions.

Since the summer of 2022, Planetary Technologies has been testing its ocean-based MRV tech in the UK, Canada, and the US.

Their goal is to remove up to 1 million tonnes of CO2 by 2028 while restoring coastal and marine ecosystems.

Planetary’s MRV breakthrough is critical as it provides an open-source protocol that guides and boosts the development of ocean carbon dioxide removal projects.

As the world’s first MRV protocol to assess CDR performance, it will help increase trust as well as finance in the sector.

When Things Get Tough for Carbon

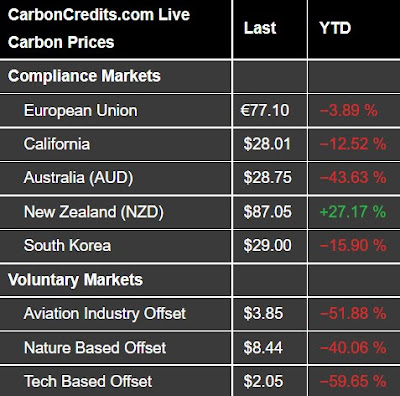

2022 was a tough year for global financial and commodity markets and the voluntary carbon market (VCM) is no exception. Xpansiv’s spot market CBL saw a couple of downturns but there’s a handful of good news, too.

Overall, there’s a 32% decrease in CBL trading volume in H2 2022. VCM-specific metrics also declined, with issuances down 6% and retirement growth slowing to 2% courtesy of carbon credit integrity concerns.

Still, the VCM strived to show its resiliency and sustained growth. Credits traded on CBL increased by 44%, spot standardized contracts trading grew by 97%.

while the volume of emissions futures traded rose by a whopping 345%. Indeed, when the going gets tough, the carbon market gets going.

Plowing Money into Forests

Companies and their funds get plowed into projects that protect and conserve critical forests.

Just this week, Stafford Capital Partners revealed the initial close of its forest carbon offset fund at $242 million from 3 UK local government pensions schemes - Essex, Leicestershire, and Swansea.

Stafford Carbon Offset Opportunity Fund, launched in December 2022, has a $1 billion fundraising target and aims to invest in these carbon projects - afforestation, natural forest restoration, and improved forest management projects.

Through the carbon offset fund, Stafford believes it can deliver the important combination of financial returns and environmental benefit that is so needed today.

Taking Carbon by Billions

As part of President Biden’s goal to bring the country to a net zero emissions economy by 2050, the Department of Energy rolled out $2.52 billion to fund two carbon capture initiatives: the “Carbon Capture Large-Scale Pilots” and the “Carbon Capture Demonstration Projects Program”.

The goal is to speed up and boost private investments in technologies that capture, transport and store carbon, to cut emissions from energy or power and hard-to-abate industries like cement and steel.

Funding comes from the President’s Bipartisan Infrastructure Law.

Carbon Fact of the Week

Heating up limestone in a kiln via the process called calcination accounts for about 4% of global CO2 emissions.

Cement is produced by heating limestone and a source of silicon, either clay or shale, in a kiln at 2000°C. Like cement, lime is produced by heating limestone, yet solely, at 900°C.

But unlike cement, lime mortars and its related products “re-absorb” CO2 emissions during their production process which can result in negative-zero (-2%) carbon emissions.

Source: https://carboncredits.com/

.jpg)

.jpg)

.jpg)

댓글

댓글 쓰기